Showing posts with label ERP (SAP). Show all posts

Showing posts with label ERP (SAP). Show all posts

Display Quotation in SAP MM T Code - ME47

Display Quotation:

For Display Quotation follow the same procedure as Maintain Quotation.

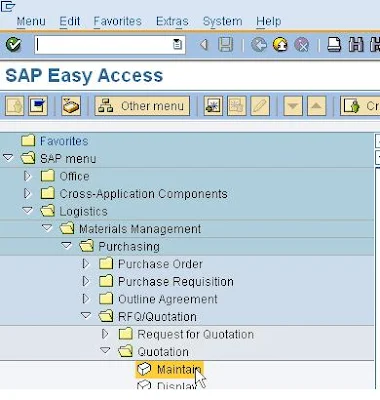

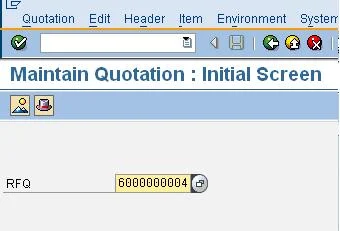

STEP : 1

Menu Path: Logistics > Material Management > Purchasing > RFQ/Quotation > Quotation > Display

Transaction Code: ME48

For Display Quotation follow the same procedure as Maintain Quotation.

STEP : 1

Menu Path: Logistics > Material Management > Purchasing > RFQ/Quotation > Quotation > Display

Transaction Code: ME48

Price Comparison in SAP MM - SAP MM User Manual T Code - ME49

Price Comparision:

STEP : 1

Menu Path: Logistics > Material Management > Purchasing > RFQ/Quotation > Quotation > Price Comparision

Transaction Code: ME49

STEP : 2

Fill up the Purchase Origination , RFQ Nos & Mean /Minimum Value Quotation and Press Execute Button.

Step : 3

View the Price Comparison and select the party for crate the Purchase Order.

STEP : 1

Menu Path: Logistics > Material Management > Purchasing > RFQ/Quotation > Quotation > Price Comparision

Transaction Code: ME49

STEP : 2

Fill up the Purchase Origination , RFQ Nos & Mean /Minimum Value Quotation and Press Execute Button.

Step : 3

View the Price Comparison and select the party for crate the Purchase Order.

SAP Vendor Master Display / Change T Code - FK03

Display/Change Vendor Master Record

1.1. Access transaction by:

1.2. On screen “Display Vendor: Initial Screen”, enter information in the fields as specified in the table below:

1.3. View the current information on the “Display Vendor: Address” screen.

Press ENTER to go to the next screen.

1.4. View the current information on the “Display Vendor: Control Data” screen.

Press ENTER to go to the next screen.

1.5. View the current information on the “Display Vendor: Payment Transactions” screen.

Press ENTER to go to the next screen.

1.6. View the current information on the “Display Vendor: Accounting Info.” screen.

Press ENTER to go to the next screen.

1.7. View the current information on the “Display Vendor: Payment Transactions” screen.

Press ENTER to go to the next screen.

1.8. View the current information on the “Display Vendor: Correspondence” screen”.

Press ENTER to go to the next screen.

1.9. Enter the necessary changes on the “Change Vendor: Withholding Tax ” screen.

Press ENTER to go to the next screen.

Accounting or purchasing personnel need to view master information for a vendor.

Business Process Description Overview

|

Vendor master data is the data required to conduct business relationships with your vendors. It includes address data and terms of payment, for example. It also controls how business transactions are posted to a vendor account and how the posted data is processed.

|

Input - Required Fields

|

Field Value / Comments

|

Vendor

|

Enter Vendor number

|

Company code

|

1000 (Your Company Code)

|

Processing Options

|

Select at least one screen from among the general data (address, control, payment transactions) or company code screens (accounting info., payment transactions, correspondence, withholding tax)

|

Procedural Steps:-

1.1. Access transaction by:

Via Menus

|

Accounting -> Financial Accounting -> Accounts Payable -> Master records -> Display

|

Via Transaction Code

|

FK03

|

1.2. On screen “Display Vendor: Initial Screen”, enter information in the fields as specified in the table below:

Field Name

|

Description

|

R/O/C

|

User Action and Values

|

Comments

|

Vendor

|

enter the vendor’s account number

|

R

| ||

Company code

|

the company code ID of the vendor

|

R

|

Use the drop down menu.

|

(Note: On above table, in column “R/O/C”; “R” = Required, “O” = Optional, “C” = Conditional)

Select the appropriate combination of general data or company code data processing

options for screens to change (Edit -> Select all selects all the field groups listed

under General Data and Company Code Data).

options for screens to change (Edit -> Select all selects all the field groups listed

under General Data and Company Code Data).

Press ENTER

Use the white left (F7) or right (F8) arrow buttons at the top left of the screen to navigate between the different general and company code data screens.

1.3. View the current information on the “Display Vendor: Address” screen.

Press ENTER to go to the next screen.

1.4. View the current information on the “Display Vendor: Control Data” screen.

Press ENTER to go to the next screen.

1.5. View the current information on the “Display Vendor: Payment Transactions” screen.

Press ENTER to go to the next screen.

1.6. View the current information on the “Display Vendor: Accounting Info.” screen.

Press ENTER to go to the next screen.

1.7. View the current information on the “Display Vendor: Payment Transactions” screen.

Press ENTER to go to the next screen.

1.8. View the current information on the “Display Vendor: Correspondence” screen”.

Press ENTER to go to the next screen.

1.9. Enter the necessary changes on the “Change Vendor: Withholding Tax ” screen.

Press ENTER to go to the next screen.

1.10. Return.

Vendor Payment Entry in SAP - T Code - F-48

DOWN PAYMENT

Post Vendor Down Payment Request in SAP

Down payment to be made to a vendor.

T Code:- F-48

Clear Vendor Down Payment Request in SAP - T Code - F-54

Clear Vendor Down Payment

Business Process Description Overview :-

You can clear the down payment with the closing invoice by either:

T Code:- F-54

Business Process Description Overview :-

You can clear the down payment with the closing invoice by either:

- Transferring the down payment to the payables account and taking account of this transfer when posting the payment, or

- Directly clearing the down payment with the invoice when the outgoing payment is made

T Code:- F-54

Park Vendor Invoice in SAP - Tcode - FB60

Park Vendor Invoice

Business Process Procedure Overview

Vendor invoice parking enables the user to enter and save (park) incomplete vendor invoices in the SAP system without executing extensive entry checks. This is especially helpful when information such as cost centers and account assignments are not available. Parked vendor invoices may be completed, checked and then posted at a later date - if necessary by a different data entry clerk. When documents are parked, data (for example, transaction figures) is not updated. Although a document number is generated the parked document may still be monitored as an open item. The data can then be evaluated online for reporting purposes from the moment they are parked, rather than having to wait until they have been completed and posted. Another advantage of the parked vendor invoices is that when used in conjunction with payment requests, It will enable the user to maximize cash discounts and pay invoices on time even when the invoice is not actually posted until after the payment.

T Code:- FB60

Business Process Procedure Overview

Vendor invoice parking enables the user to enter and save (park) incomplete vendor invoices in the SAP system without executing extensive entry checks. This is especially helpful when information such as cost centers and account assignments are not available. Parked vendor invoices may be completed, checked and then posted at a later date - if necessary by a different data entry clerk. When documents are parked, data (for example, transaction figures) is not updated. Although a document number is generated the parked document may still be monitored as an open item. The data can then be evaluated online for reporting purposes from the moment they are parked, rather than having to wait until they have been completed and posted. Another advantage of the parked vendor invoices is that when used in conjunction with payment requests, It will enable the user to maximize cash discounts and pay invoices on time even when the invoice is not actually posted until after the payment.

T Code:- FB60

Post Parked Document in SAP - Transaction Code - FBV0

How To post a parked general ledger document

Business Process Procedure Overview:

Document parking can be use to enter and store (park) incomplete documents in the SAP System, without carrying out extensive entry checks. Parked documents can be completed, checked and then posted at a later date - if necessary by a different data entry Clerk.

Parked documents can be post either individually or via a list. To post several parked documents via a list, the system issues a list of parked document for you to choose from. From this list, you can then carry out any necessary post-processing to parked documents that could not be posted due to missing information such as a cost accounting assignment.

T Code:- FBV0

Business Process Procedure Overview:

Document parking can be use to enter and store (park) incomplete documents in the SAP System, without carrying out extensive entry checks. Parked documents can be completed, checked and then posted at a later date - if necessary by a different data entry Clerk.

Parked documents can be post either individually or via a list. To post several parked documents via a list, the system issues a list of parked document for you to choose from. From this list, you can then carry out any necessary post-processing to parked documents that could not be posted due to missing information such as a cost accounting assignment.

T Code:- FBV0

Change Parked Document Line Item in SAP

Change Parked Document

Business Process Procedure Overview :-

Document parking can be use to enter and store (park) incomplete documents in the SAP System, without carrying out extensive entry checks. Parked documents can be completed, checked and then posted at a later date - if necessary by a different data entry clerk.

Parked document may also be changed. Changing a parked document is broken up to two transaction codes: FBV2 and FBV4. To change line items details transaction code FBV2 should be use while transaction code FBV4 is use to change header detail. This BPP will illustrate the process to change line item detail, transaction code FBV2. Refer to BPP on “Change Header Detail” to view more information on changing a parked document’s header detail.

Business Process Procedure Overview :-

Document parking can be use to enter and store (park) incomplete documents in the SAP System, without carrying out extensive entry checks. Parked documents can be completed, checked and then posted at a later date - if necessary by a different data entry clerk.

Parked document may also be changed. Changing a parked document is broken up to two transaction codes: FBV2 and FBV4. To change line items details transaction code FBV2 should be use while transaction code FBV4 is use to change header detail. This BPP will illustrate the process to change line item detail, transaction code FBV2. Refer to BPP on “Change Header Detail” to view more information on changing a parked document’s header detail.

T Code:- FBV2

Display Parked Documents In SAP - T Code FBV3

Display Parked Document

To display a parked document

Business Process Procedure Overview

Document parking can be use to enter and store (park) incomplete documents in the SAP System, without carrying out extensive entry checks. Parked documents can be completed, checked and then posted at a later date - if necessary by a different data entry clerk.

Parked documents may be display individually or via a list.

T Code :- FBV3

To display a parked document

Business Process Procedure Overview

Document parking can be use to enter and store (park) incomplete documents in the SAP System, without carrying out extensive entry checks. Parked documents can be completed, checked and then posted at a later date - if necessary by a different data entry clerk.

Parked documents may be display individually or via a list.

T Code :- FBV3

Enter Vendor Credit Memo in SAP ( Park / Post ) T Code :- FB65 , FBR2

CREDIT MEMO’s

Enter (Park / Post) Vendor Credit Memo

Receive a credit memo from vendor for overcharged/damaged items

Business Process Procedure Overview:-

A vendor credit memo is the reversal of part or all of an invoice. When an invoice is cancelled, the system automatically creates a credit memo. The credit memo posting is similar to other standard document postings within the SAP R/3 system. Once posted, the credit memo is applied against the vendor account balance, and subsequently offsets future payments.

T Code: FB65 , FBR2

Enter (Park / Post) Vendor Credit Memo

Receive a credit memo from vendor for overcharged/damaged items

Business Process Procedure Overview:-

A vendor credit memo is the reversal of part or all of an invoice. When an invoice is cancelled, the system automatically creates a credit memo. The credit memo posting is similar to other standard document postings within the SAP R/3 system. Once posted, the credit memo is applied against the vendor account balance, and subsequently offsets future payments.

T Code: FB65 , FBR2

Document Display in SAP T Code - FB03

With the help of this T code you can display / see the details of any Document in SAP.

Business Process Description Overview

This process will display a previously created accounting document. To display a specific document, enter document number, company code and fiscal year (optional).

T Code :- FB03

Display Account Balances

Business Process Description Overview

This process will display a previously created accounting document. To display a specific document, enter document number, company code and fiscal year (optional).

T Code :- FB03

Mass Document Reversal in SAP T Code - F.80

Mass Reversal of Documents

Business Process Description Overview

A function you can use to reverse many documents, which have been posted either manually or automatically.

Mass reversal offers two modes for reversing documents:

T Code :- F.80

A function you can use to reverse many documents, which have been posted either manually or automatically.

Mass reversal offers two modes for reversing documents:

- Reversal (for reversing documents in the same period in which the target document was posted)

- Inversion (for reversing documents in a different period)

T Code :- F.80

Vendor Account Clearing in SAP T code - F-44

Clear Vendor

Used to clear open items from one vendor account.

Business Process Description Overview

Used to clear open items from one vendor account.

Business Process Description Overview

This function differs from posting with a clearing transaction or posting with a payment in the following ways:

T Code :- F-44

- You do not need to enter a document header

- You can only clear open items from one account

T Code :- F-44

Post Outgoing Payment in SAP T Code - F-53

PAYMENTS

Post Out Going Payment

Manual payment on an existing vendor invoice.

Business Process Description Overview:-

Manual payment on an existing vendor invoice.

Business Process Description Overview:-

This is a posting for those checks that are created manually (outside the SAP R/3 system, perhaps typed or hand-written). A check will not be generated in R/3 but the vendor and cash accounts will be updated appropriately.

T Code :- F-53

Create Remittance Challan in SAP T Code - J1INCHLN

With holding Taxes

Creation of Remittance Challan

TRANSACTIONAL STEPS- Creation of Remittance Challan

BUSINESS PROCESS STEPS / BPP NUMBER:-

At month end Post Challan for the purpose of depositing the Withholding taxes

T Code :- J1INCHLN

Creation of Remittance Challan

TRANSACTIONAL STEPS- Creation of Remittance Challan

BUSINESS PROCESS STEPS / BPP NUMBER:-

At month end Post Challan for the purpose of depositing the Withholding taxes

T Code :- J1INCHLN

Updating Remittance Challan in SAP T Code - J1INBANK

Updating Remittance Challan

TRANSACTIONAL STEPS- Update TDS Remittance Challan Details (Bank Challan Update – Create Bank Challan)

BUSINESS PROCESS STEPS / BPP NUMBER

Update the Bank Challan no.

T Code :- J1INBANK

TRANSACTIONAL STEPS- Update TDS Remittance Challan Details (Bank Challan Update – Create Bank Challan)

BUSINESS PROCESS STEPS / BPP NUMBER

Update the Bank Challan no.

T Code :- J1INBANK

TDS Certificate Printing in SAP T Code - J1INCERT

Printing TDS Certificate

TRANSACTIONAL STEPS- Print TDS Certificates

BUSINESS PROCESS STEPS / BPP NUMBER:-

Printing of TDS Certificates for the Vendor

T Code :- J1INCERT

TRANSACTIONAL STEPS- Print TDS Certificates

BUSINESS PROCESS STEPS / BPP NUMBER:-

Printing of TDS Certificates for the Vendor

T Code :- J1INCERT

Display Customer Master Data / Record in SAP T Code- FD03

Displaying Customer Master Record

Accounting or purchasing personnel need to view master information for a Customer.

Business Process Description Overview

Customer master data is the data required to conduct business relationships with your Customers. It includes address data and terms of payment, for example. It also controls how business transactions are posted to a Customer account and how the posted data is processed.

Accounting or purchasing personnel need to view master information for a Customer.

Business Process Description Overview

Customer master data is the data required to conduct business relationships with your Customers. It includes address data and terms of payment, for example. It also controls how business transactions are posted to a Customer account and how the posted data is processed.

T Code :- FD03

Articles By Categories

10th Class E Book

11th Class E Book

12th Class E Book

Account Documents Examples

Bank Guarantee Document

Banking Documents Samples

Blogger Tips and Tricks

Commercial Documentation Examples

company secretary documents

Corporate Requirements

Ebook pdf

Educational Materials

ERP (SAP)

Export Import Documentation

FEATURED POSTS

HR Documentation Templates

Income Tax Documents

Insurance Documentation Examples

Legal Documents Requirements

Letter of Credit Required Documents

Logistics Documents Requirements

Marketing Department Functions

Massachusetts Mesothelioma Lawyer

Mesothelioma

Production Documentation Format

Purchase Department Required Documents

SAP - FICO User Manual

SAP - MM User Manual

SAP - PP User Manual

SAP - Sales and Distribution (SD) User Manual

Stories

Study Materials

Trademark Documents

tutorials