Sample Template Example of Preference Shares Allotment Rules & Procedure in Word in Word / Doc / Pdf Free Download

As per the existing provisions of the Takeover Code,

an acquirer who holds between 15% and 55% of the shares of a listed company is

allowed to acquire upto 5% stake in such company during a financial year ending

31st March.

Directors of the target company

Increase of Promoters holding by preferential issue of

Shares

Download Format

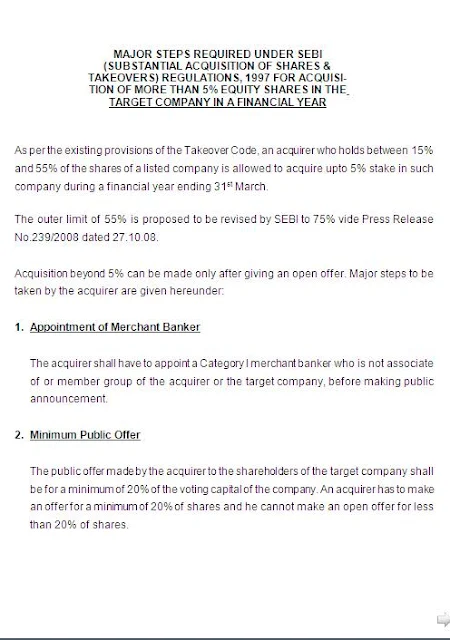

MAJOR STEPS REQUIRED UNDER SEBI (SUBSTANTIAL ACQUISITION

OF SHARES & TAKEOVERS) REGULATIONS, 1997 FOR ACQUISI-TION OF MORE THAN 5%

EQUITY SHARES IN THE TARGET COMPANY IN A FINANCIAL YEAR

|

As per the existing provisions of the Takeover Code,

an acquirer who holds between 15% and 55% of the shares of a listed company is

allowed to acquire upto 5% stake in such company during a financial year ending

31st March.

The outer limit of

55% is proposed to be revised by SEBI to 75% vide Press Release No.239/2008 dated

27.10.08.

Acquisition beyond

5% can be made only after giving an open offer. Major steps to be taken by the

acquirer are given hereunder:

1.

Appointment of

Merchant Banker

The

acquirer shall have to appoint a Category I merchant banker who is not associate

of or member group of the acquirer or the target company, before making public

announcement.

2.

Minimum Public

Offer

The

public offer made by the acquirer to the shareholders of the target company

shall be for a minimum of 20% of the voting capital of the company. An acquirer

has to make an offer for a minimum of 20% of shares and he cannot make an open

offer for less than 20% of shares.

3.

Public

Announcement

It is

an announcement made by the acquirer through a merchant banker disclosing his

intention to acquire minimum of 20%

shares/voting rights of the target

company from existing shareholders by means of an open offer.

Public

announcement must be made in English and also in a vernacular language daily

news paper circulating in the state where registered office of the target

company is situated and the stock exchange where the shares are most frequently

traded.

The

public announcement must specify a date, which shall be the specified date for

the purpose of determining the names of the shareholders to whom the letter of

offer should be sent.

4. Escrow Account

The

acquirer must create an Escrow Account of 25% of the consideration for offer

sizes less than Rs.100 Crores and 10% for the excess consideration above Rs.100

Crores. The escrow account shall consist of cash deposited with a scheduled

commercial bank.

5. Filing Letter of Offer with SEBI

A Letter of Offer (L.O.) must be filed with SEBI

within 14 days from the date of public announcement. A hard and soft copy of

the Public Announcement (P.A.) along with publication made in news papers and

prescribed filing fee by way of Bankers’ Cheque or Demand Draft is to be

remitted.

6. Minimum Offer Price

L.O.

must contain the minimum offer price. While determining minimum offer price,

the acquirer in consultation with merchant bankers to take into consideration

all parameters mentioned in the regulation.

7. Minimum number of Shares to be acquired

The

public offer shall be for a minimum of 20% of the voting capital.

8.

General

obligations of the acquirer

i)

The public announcement of offer to acquire the shares of

target company shall be made only when the acquirer is able to implement the

offer.

ii)

Within 14 days of the public announcement of the offer, the

acquirer shall send a copy of the draft letter of offer to the target company

at its registered office address, for being placed before the board of

directors and to all the stock exchanges where the shares of the company are

listed.

iii)

The acquirer shall ensure that the letter of offer is to be

sent to all the shareholders (including non-resident Indians) of the target

company, whose names appear on the register of members of the company as on the

specified date mentioned in the public announcement:

Provided

that where the public announcement is made pursuant to an agreement to acquire

shares or control over the target company, the letter of offer shall be sent to

shareholders other than the parties to the agreement.

9.

General obligation of the Board of

Directors of the target company

The Board of Directors of the target

company is also under obligation to abide by the requirement prescribed under

the Regulation regarding disposal of assets, entering into material contract,

appointment of Directors etc.

10.

Penalty

SEBI

(Substantial Acquisition of Shares and Takeovers) Regulations, 1997 lays down

the obligation of acquirer, target company and merchant Bankers. Failure or

non-compliance’s of provisions of the Regulations by them would entail penal

consequences.

PREFERENTIAL ALLOTMENT OF SHARES |

Promoters’

holding may be increased by issue of equity shares to them on private placement basis. However limitation

prescribed under the provisions of SEBI (Substantial Acquisition of Shares and

Takeovers) Regulations 1997 will also be applicable here. A brief note an

preferential issue of shares is given below:

1.

Alteration of Articles of Association of the company to

enable it to raise fund by issuing equity shares by way of private placement

should be made.

2.

Alteration of Capital clause of the Memorandum of

Association, if needed, should be made.

3.

Prior permission of Banks & FIs’ for change in Capital

structure as per their terms of sanction should be obtained.

4.

Determination of ‘Relevant date’ which means the date thirty

days prior to the date of General Meeting convened to consider the proposal.

5.

Fixing the Price of the shares to be issued as per

guidelines.

6.

Advance intimation to Stock Exchanges of the Board Meeting to be held for approval of:

a)

Preferential Issue

b)

Increase of authorised capital

c)

Approval of Notice to the shareholders for the Preferential

Issue and related activities

7.

Information to Stock Exchanges of the decision to issue

shares on private placement basis.

8.

Certificate from Statutory Auditors to be obtained

confirming that the proposed allotment is in accordance with SEBI Guidelines on

preferential allotment of shares.

9.

Notice of General Meeting to be sent shareholders.

10.

Three copies of the Notice of the General Meeting to be sent

to Stock Exchanges.

Contd…P/2

-

2 –

11.

In-principle approval for such issue to be obtained from

Stock Exchanges.

12.

General Meeting to be held for approval of Preferential

Issue by way of Special Resolution.

13.

Minutes of General Meeting to be sent Stock Exchanges.

14.

The requisite form to be filed with Registrar of Companies.

15.

A letter/placement document to be sent the proposed allottee

(s) asking him for subscription.

16.

The proposed allottee(s) should be informed of the date of

allotment along with the names, addresses of the Stock Exchanges on which the

Company’s Shares are listed.

17.

The Stock Exchanges to be informed of the allotment of

Shares with the details of allotment.

18.

Allottees account to be credited with the number of shares

allotted.

19.

Application to be filed with the Stock Exchange for listing

of the Shares.

20.

The acquirer has to disclose such acquisition under Insider

Trading Regulations.

21.

The details of all monies (proceeds of preferential issue)

utilised and unutilised should be disclosed in the Balance Sheet.

22.

Since Statutory Auditors has to give the certificate of

compliance, the mater should be discussed with the auditors first.

Steps to be taken for Acquisition of more than 5%

shares by the Promoters Group in any

Financial Year

1) More than 5%

Equity Shares can be acquired in any Financial year only after making a public

announcement to acquire at least additional 20% shares of the target company

from the shareholders through on open offer.

2) For making some

public announcement the promoter has to appoint a merchant banker registered

with SEBI.

3) A hard copy and

soft copy of the PA are required to be filed with SEBI simultaneously with the

publication of the same in the news paper.

4) A draft letter of offer is required to be filed

with SEBI within 14 days from the date of Public Announcement along with a

filing fee of Rs.50,000/- per letter of offer (payable by Banker’s Cheque /

Demand Draft) A due diligence certificate as well as registration details as

per SEBI circular no. RMB (G-1) series dated June 26, 1997 are also required to

be filed alongwith the draft letter of offer.

5) The MB will

incorporate in the letter of offer the comments made by SEBI and then send

within 45 days from the date of PA the letter of offer along with the blank

acceptance form , to all the shareholders whose names appear in the register of

the company on the Specified Date. The offer remains open for 20 days. The

shareholders are required to send their Share certificate(s) / related

documents to registrar or Merchant banker as specified in PA and letter of

offer. The acquirer is required to pay consideration to all those shareholders

whose shares are accepted under the offer, within 15 days from the closure of

offer.

6) SEBI does not

approve the offer price. The acquirer/ Merchant Banker is required to ensure

that all the relevant parameters are taken in to consideration while

determining the offer price and that justification for the same is disclosed in

the letter of offer.

7) Acquirers are required to complete the payment

of consideration to shareholders who have accepted the offer within 15 days

from the date of closure of the offer. In case the delay in payment is on

account of non receipt of statutory approvals and if the same is not due to

wilful default or neglect on part of the acquirer, the acquirers would be

liable to pay interest to the shareholders for the delayed period in accordance

with Regulations.

8) No, if the shares

received by the acquirer are more than the shares agreed to be acquired by him,

the acceptance would be on proportionate basis.

9) Before making the

Public Announcement, the acquirer has to open an escrow account in the form of

cash deposited with a scheduled commercial bank or bank guarantee in favour of

the Merchant Banker or deposit of acceptable securities with appropriate margin

with the Merchant Banker. The Merchant Banker is also required to confirm that

firm financial arrangements are in place for fulfilling the offer obligations.

In case, the acquirer fails to make the payment, MB has a right to forfeit the

escrow account and distribute the proceeds in the following way.

10) Besides forfeiture

of escrow account, SEBI can initiate separate action against the acquirer which

may include prosecution / barring the acquirer from entering the capital market

for a specified period etc.

Increase of Promoters holding by preferential issue of

Shares

1) Intimation to

Stock Exchanges at least 7 days before the Board Meeting in which the board

will consider the Preferential Issue of Shares.

2) Preferential Issue

of Shares to be approved by the Board of Directors.

3) Notice convening a

Shareholders Meeting and the Explanatory Statement to be approved by the Board.

4) Board to consider

whether increase of authorised capital and consequent amendment to Memorandum

and Articles of Association is required.

5) Amendment to

Articles of Association to provide for making preferential allotment.

6) Determination of

share prices of the company as per SEBI guidelines for preferential issue and

certificate from the Statutory Auditors for calculation of price.

7) In principle

approval from the Stock Exchanges to be taken.

8) If by virtue of

preferential allotment of shares the limit of 5% of the total equity base is

exceeded the promoter has to give open offer as the SEBI Substantial

Acquisition of Shares and Takeover Regulation.

9) In the case of a

listed company, three copies of the notice of the meeting shall be forwarded to

each of the stock exchanges.

10) To ensure that the

proposed allottees hold Shares in dematerialized form only.

11) To ensure that the

proposed allottees have not sold the Shares of the company within a period of 6

months before the relevant date. If so, they shall not be eligible to be

allotted Shares.

12) To make an

application to stock exchanges where the Shares of the company are listed for

in-principle approval of the Shares that are to be issued on a preferential

basis.

13) In case of issue

of Shares for consideration other than cash, get the assets that are proposed

to be acquired valued by a Valuer, who shall be either a chartered accountant

or merchant banker.

14) To obtain a

certificate from the statutory auditors that the proposed allotment is in

accordance with the SEBI Guidelines on preferential Allotment.

15) Hold general

meeting. Place the Auditors’ Certificate before the members. Consent of

shareholders by way of special resolution for preferential issue is require.

16) File Form 23 with

ROC within 30 days of passing of special resolution.

17) If authorised

share capital was increased, ensure to file form No.5 along with Form 23 with

necessary fees within 30 days of the meeting. Form No.5 must bear adequate

stamp duty.

18) If consent of

members is received by way of ordinary resolution only, instead of special

resolution, the approval of the Central Government (Ministry of Corporate Affairs)

is required.

19) Receive

application money along with application forms, duly filled in,

20) To ensure that

allotment is done within 15 days of the passing of the Special Resolution.

21) Convene Board

Meeting for considering allotment. Pass resolution for allotment.

22) To intimate

details of lock-in to both the depositories.

23) To apply to the

Stock Exchange for final listing.

24) For allotment to

NRIs, provisions of FEMA be kept in mind.

25) In case of

allotment of Shares to mutual funds, financial institutions the respective

agreements shall be signed and executed.

26) In the case of a

listed company, send intimation to the stock exchanges regarding the allotment

of Shares as approved by the Board.

27) Ensure that the

demat account of the allottees are within 15 days of the passing of the special

resolution credited after paying the necessary stamp duty.

28) To list the Shares

of the company with the Stock Exchange.

29) Within 30 days of

allotment, file return of allotment with Registrar of Companies.

30) Update member’s

register and if so required, register of directors’ shareholding.

31) If debentures were

issued with an option to convert the whole or part into Shares, check the

applicability of the Public Companies (Terms of Issue of debentures and Raising

of Loans with Option to Convert such Debentures or Loans into Shares) Rules,

1977. Where the rules are not complied with, prior approval of the Central

Government to be obtained.

Download Format

0 comments:

Post a Comment