Sample Template Example of Non Performance Explanation Letter to Bank in Word / Doc / Pdf Free Download

Download Format

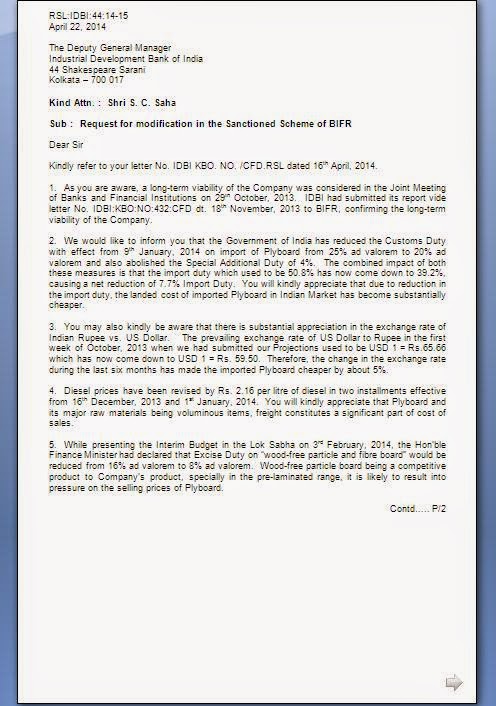

RSL:IDBI:44:14-15

April 22, 2014

The Deputy General Manager

Industrial Development Bank of India

44 Shakespeare Sarani

Kolkata – 700 017

Kind Attn. : Shri S. C. Saha

Sub : Request for modification in the Sanctioned

Scheme of BIFR

Dear Sir

Kindly refer to your letter No. IDBI KBO. NO. /CFD.RSL dated

16th April, 2014.

1. As you are aware, a long-term viability

of the Company was considered in the Joint Meeting of Banks and Financial

Institutions on 29th October, 2013.

IDBI had submitted its report vide letter No. IDBI:KBO:NO:432:CFD dt. 18th

November, 2013 to BIFR, confirming the long-term viability of the Company.

2. We would like to inform you that the

Government of India has reduced the Customs Duty with effect from 9th

January, 2014 on import of Plyboard from 25% ad valorem to 20% ad valorem and

also abolished the Special Additional Duty of 4%. The combined impact of both these measures is

that the import duty which used to be 50.8% has now come down to 39.2%, causing

a net reduction of 7.7% Import Duty. You

will kindly appreciate that due to reduction in the import duty, the landed

cost of imported Plyboard in Indian Market has become substantially cheaper.

3. You may also kindly be aware that there

is substantial appreciation in the exchange rate of Indian Rupee vs. US

Dollar. The prevailing exchange rate of

US Dollar to Rupee in the first week of October, 2013 when we had submitted our

Projections used to be USD 1 = Rs.65.66 which has now come down to USD

1 = Rs. 59.50. Therefore, the change in the exchange rate during the last six months has made the imported Plyboard cheaper by about 5%.

1 = Rs. 59.50. Therefore, the change in the exchange rate during the last six months has made the imported Plyboard cheaper by about 5%.

4. Diesel prices have been revised by Rs.

2.16 per litre of diesel in two installments effective from 16th

December, 2013 and 1st January, 2014. You will kindly appreciate that Plyboard and

its major raw materials being voluminous items, freight constitutes a

significant part of cost of sales.

5. While presenting the Interim Budget in

the Lok Sabha on 3rd February, 2014, the Hon’ble Finance Minister

had declared that Excise Duty on “wood-free particle and fibre board” would be

reduced from 16% ad valorem to 8% ad valorem.

Wood-free particle board being a competitive product to Company’s

product, specially in the pre-laminated range, it is likely to result into pressure

on the selling prices of Plyboard.

Contd….. P/2

- 2 -

6. All these factors may result into lower

selling prices of our products, as considered in our Projections submitted to

you in October, 2013. We have,

therefore, considered an average reduction of about Rs. 500/- per MT. You will kindly appreciate that it would not

be possible on our part to anticipate all these factors, as the factors are

emanated either from Government Policies or from Macro Economic / International

prevailing situation. Moreover, the

impact of these factors is quite significant which, we realise, would be better

if the same factors are built into the Projections.

7. Apart from the aforesaid adverse

developments, there have certain favourable developments also for the Company,

which are given below :

a)

We

had in our Projections for the year 2013-14 considered a sale of 19200 MT and

in fact, we have actually exceeded our earlier targets, as the actual sale has

stood at 19480 MT, showing a growth of 13% over the sales achieved during the

year 2012-13. In the backdrop of 13%

volume growth, as achieved by the Company during 2013-14, as compared to

immediately preceding year, we have considered 7% growth in our Projections for

the year 2014-15.

b)

During

the year 2013-14, there have been substantial savings achieved in consumption

of various raw materials and other elements of cost as a percentage of sale

value which is given in Annexure-A. These savings achieved by the Company have

definitely reduced the overall cost of production and sales which has been

in-built in the Projections, as submitted to you.

8. As desired by you, we are enclosing

herewith a statement as Annexure-B showing the amount of carried forward losses

and unabsorbed depreciation which would entitle us to create substantial amount

of deferred tax assets. We will get the

same certified by a practicing Chartered Accountant in due course of time.

We hope, the aforesaid

information will serve your purpose. Should you require any further

information, we shall be pleased to submit the same.

Thanking you

Yours faithfully

For ROCKET SALES LTD.

NEETU SINGH

MANAGING DIRECTOR

Encl. As above

Download Format

0 comments:

Post a Comment